Top 10 VC Firms in Germany

Germany is one of the hottest innovation hubs in Europe. The German venture capital market is dynamically growing day by day. The VCs support innovation, helping German ventures play a major role in the world of entrepreneurship. These VC firms work together to find possibilities in the booming business sectors. Here is a list of the top 10 prominent VC firms in Germany:

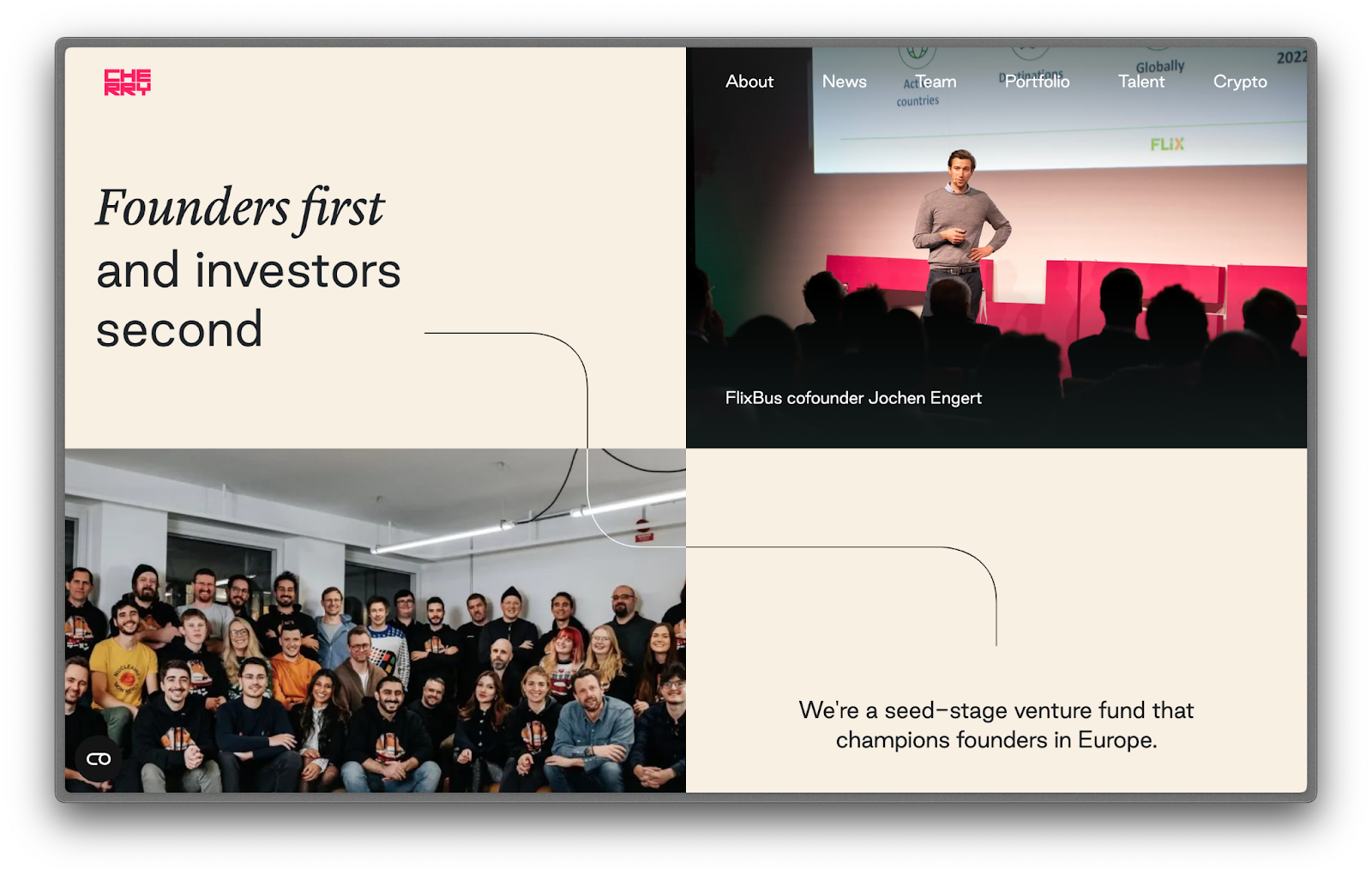

1. Cherry Ventures

Cherry Ventures is an early-stage venture capital firm. Florian Nöll, the former CEO of Rocket Internet, started it. Rocket Internet is a big investment company in Europe. This firm is led by a team of entrepreneurs with experience building fast-scaling companies such as Zalando and Spotify. The firm backs Europe's boldest founders, usually as their first institutional investor, and supports them in everything from their go-to-market strategy and the scaling of their businesses. Cherry Ventures has previously invested in the seed stage of 90+ companies across Europe

Website: cherry.vc

Founding Year: 2018

Investment Range: €300k to €3M

Stage: Pre-seed, Seed

Sector: Multi

Investment Geography: Europe

Notable Investments: FlixBus, Auto1 Group, Flaschenpost, Forto, SellerX, Juni, Flink

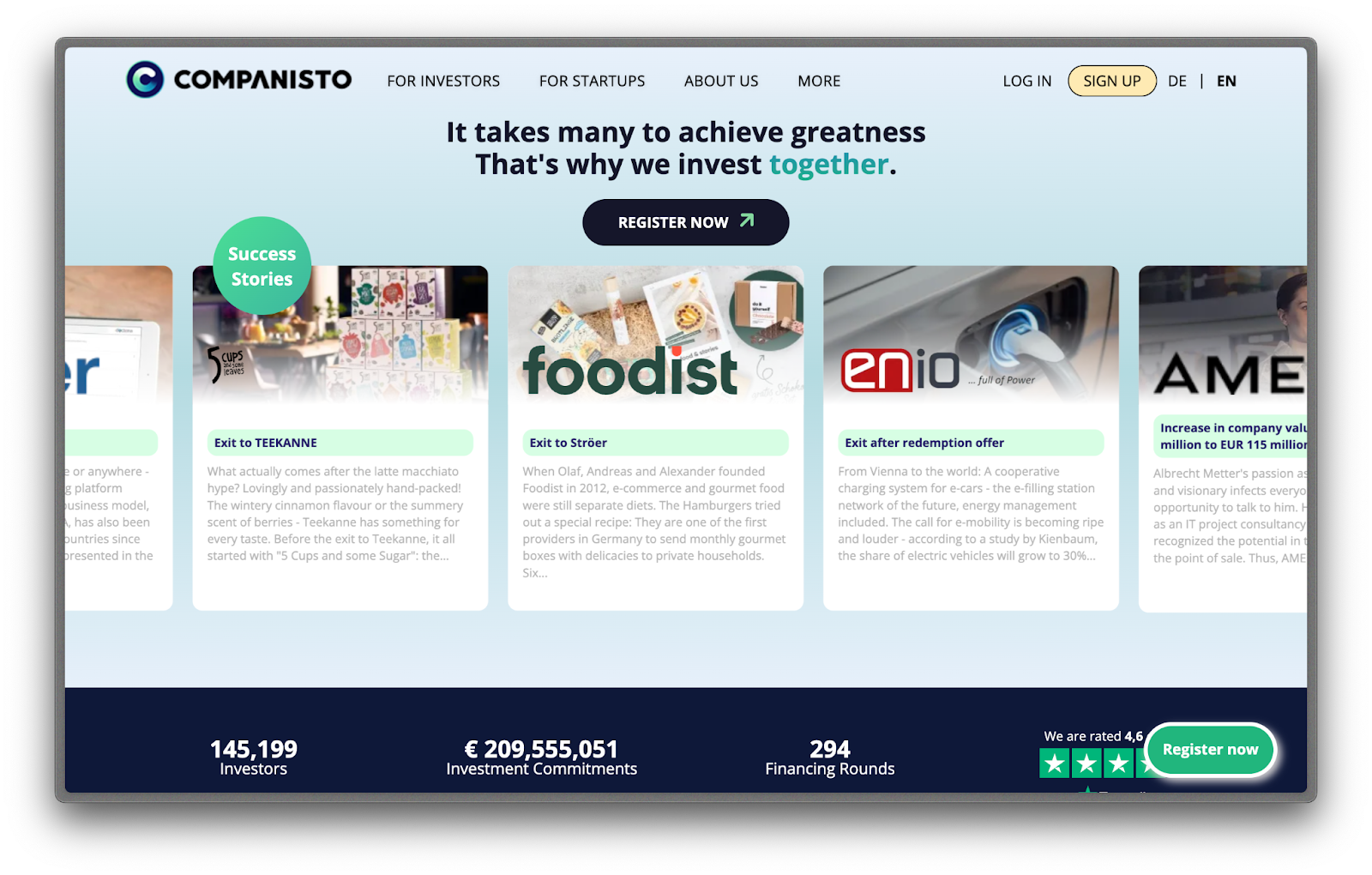

2. Companisto

Companisto, based in Berlin, is a company that supports startups by connecting them with multiple investors. It was founded by Florian Alt and Fabian Holler. Companisto acts as a middleman between companies and investors, allowing investors (known as Companists) to pool their money and collectively invest in a company. In exchange for their investment, Companists receive a share of the profits and potential proceeds when the startup is sold.

Website: companisto.com

Founding Year: 2012

Investment Range: up to €2.5 million

Stage: Pre seed, Seed

Sector: Finance, FinTech

Investment Geography: Europe

Notable Investments: Doxter, Foodist, Ameria, Solernative, KoRa

3. Fly Ventures

Fly is an early-stage venture capital firm that supports technical founders tackling challenging problems. They provide funding from the very beginning (day-zero) to the seed stage and are open to backing founders from across Europe.

Fly is an early-stage venture capital firm that supports technical founders tackling challenging problems. They provide funding from the very beginning (day-zero) to the seed stage and are open to backing founders from across Europe.

Website: fly.vc

Founding Year: 2016

Investment Range: €1 M-€5M (€3 million avg./company)

Stage: Early Stage

Sector: Multi

Investment Geography:Europe

Notable Investments: Axiom, Metaview, Lakers, Wayve

4. JVH Ventures

JVH Ventures was established by Johannis Hatt, the founder of companies like Productsup and FaceAdNet. With over 20 years of entrepreneurial experience, they offer support to founders, sharing their extensive knowledge from diverse startup areas. Their main focus is on investing in the early stages (angel and seed) of startups that have the potential for significant growth. They target startups operating in expanding markets, led by enthusiastic and dedicated entrepreneurs.

Website: jvh-ventures.com

Founding Year: 2010

Investment Range: $1M - 5M

Stage: Early Stage

Sector: Multi

Investment Geography: Europe

Notable Investments: CoachHub, Kyte, Evermood, 8returns, Cleverly

5. APX

APX is a prominent early-stage venture capital firm located in Berlin, Europe. It issupported by Axel Springer and Porsche. They collaborate with highly ambitious startup founders, often being their first investors.

Website: apx.vc

Founding Year: 2018

Investment Range: €50k - €500k

Stage: Very Early Stage

Sector: Multi

Investment Geography: Europe, north America

Notable Investments: Ridebee, Cyclio, Eleos, Sway

6. 10K Ventures

10K Ventures is an angel investor group and venture capital firm located in Berlin, Germany. They specialize in providing early-stage investments to tech startups and funds. The firm is backed by the individuals Hansol Joo and Kim Diocampo and has a track record of investing in startups across Europe, Asia, and the United States.

Website: 10kv.super.site

Founding Year: 2019

Investment Range: $100K - $250K

Stage: Early Stage, Seed, Private Equity

Sector: E-commerce, Enterprise Infrasturcutres

Investment Geography: Europe, Asia, North America

Notable Investments: Syra Coffee, Nestcoin, Klub, Finblox

7. STS Ventures

STS Ventures is a hub for business angel activities of Stephan Schubert, a successful Cologne-based entrepreneur and investor with a strong track record in the German internet industry. If you need honest advice and timely feedback from an experienced entrepreneur, STS Ventures might be the right partner for you.

Website: sts-ventures.de

Founding Year: 2006

Investment Range: €200k - €500k

Stage: Early Stage

Sector: Multi

Investment Geography: Germany, Austria, and Switzerland

Notable Investments: Talentspace, Justwatch, B2X, Ottonova

8. Visionaries Club

Visionaries Club is a top European early-stage venture capital firm. They have offices in London and Berlin and are supported by successful digital founders and family business entrepreneurs in Europe. Their belief is that entrepreneurs benefit most from the authentic knowledge and connections of their investor network.

Website: visionaries.vc

Founding Year: 2019

Investment Range: $100K - $5.0M

Stage: Early Stage

Sector: B2B Focused

Investment Geography: Europe

Notable Investments: Personio, Xentral, Pigment, Choco, Miro

9. HV Capital

HV Capital, formerly known as HV Holtzbrinck Ventures, has been supporting internet and technology companies across different fund generations. They stand out as one of Europe's most successful and financially robust early-stage and growth venture capital firms.

Website: hvcapital.com

Founding Year: 2000

Investment Range: €500k-€5m

Stage: Early - Late Stage

Sector: Tech, Multi

Investment Geography: Europe

Notable Investments: Delivery Hero, HelloFresh, Penta, Groupon, Zalando

10. Earlybird

Earlybird invests in all stages of tech companies' growth. They're one of Europe's top venture investors, providing money, strategic help, and access to global connections and financial markets to the companies they invest in.

Website: earlybird.com

Founding Year: 1997

Investment Range: $10M-$50M

Stage: Early Stage, Late Stage, Private Equity

Sector: Innovation Technology

Investment Geography: Europe (Primary), North America, Asia

Notable Investments: Lilium, Targomo, Myriad, Urbia, Aiven

Finally raise your round with Investor Hunt